A country takes in money by taxing the output of it's citizens. Zimbabwe’s economy is made up, in large part, of agricultural based products; farms. So a large part of the taxes came from the output of farmers.

Let’s back up for just a moment. The country of Zimbabwe has it’s roots in the British colonial system. This means that by the time Zimbabwe was becoming independent, a small percentage of white, British descendents, owned and farmed the vast majority of the farmland in the new country. I am not here to debate the right or wrong of that situation, but when Mugabe took power in 1998, he undertook the task of changing that.

In 2000, Mugabe allowed the black veterans of Zimbabwe’s war of independence to invade the farms of the white land owners, and take the land by force. Right or wrong, the white landowners had been able to work the land to great advantage and were providing large amounts of money to the Zimbabwe treasury. When they were driven from the country, farm outputs were cut in half when comparing 2000 to 2007. Mugabe’s brutal action did not go unnoticed by the Europe and the United States. They instituted tough sanctions. That meant that outside infusions of capital through investment and capital dried up.

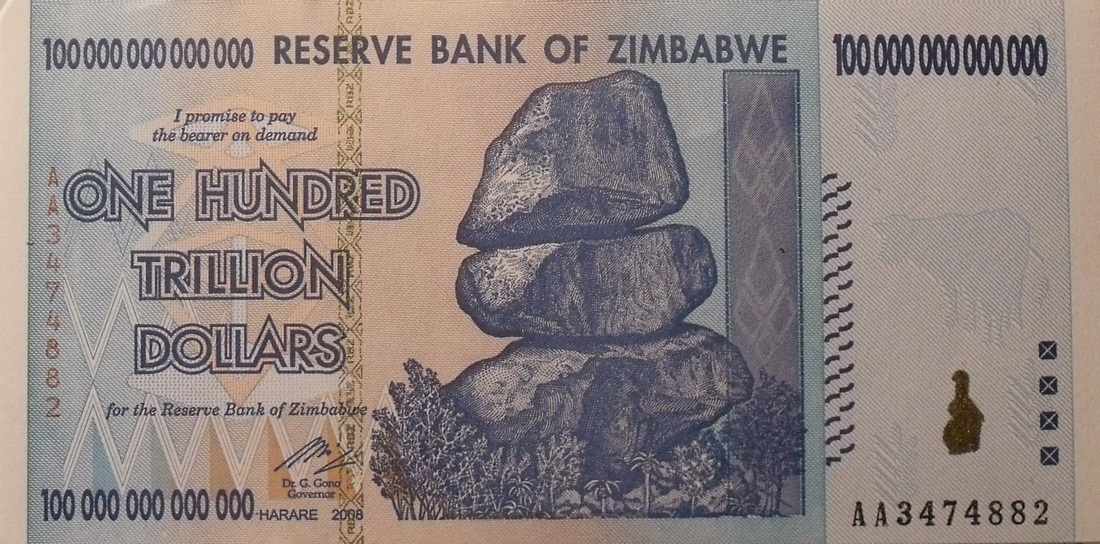

With expenditures up, revenues down, and little means of borrowing money, Zimbabwe began to print money. Inflation, the decrease in the purchasing power of the monetary unit, was the result. Inflation comes about when there is more money (and credit) competing for the same or few amounts of goods and services. It’s like if you could use a scoop of dirt to buy a hamburger. Dirt is so plentiful, that the next person will offer two scoops for the same hamburger, so you end up having to offer three.

This is a gross oversimplification, but the principle is the same. To keep up with the increased demands of inflation, the Reserve bank of Zimbabwe printed more money, and then higher denominations to try to pay for their obligations, especially with other nations. Those nations who contracted to provide a good or service to a Zimbabwean for x amount of Z-dollars, found at time of payment, those dollars could buy much, much less. They would demand more Z-dollars in compensation. More Z-dollars were printed and the cycle repeated and intensified.

What was the result of this, other than money littered with zeros? An estimated quarter of the population, 3.4 million people left the country, to escape the poverty and starvation. Another million essentially became homeless. The entire healthcare system was decimated and ceased to exist for practical purposes. Cholera and AIDS became epidemic. The most productive citizens left to a friendlier and more stable country.

Today Zimbabwe does not print any money and uses foreign currency to make day to day transactions.

The United States is not Zimbabwe, and we are much more insulated against the factors that caused their economic collapse. But, the fact remains that America is traveling along the same path. We are printing more money than we ever have, and are doing nothing to abate it. Obama’s most recent budget proposal seeks to increase the rate of spending, rather than slow it down.

Zimbabwe could not collect enough in taxes to offset the amount of spending the government had elected to do. The United States is in the same situation. In our history we have had top marginal income tax rated between 7% and 94%. In the 100 year history of income taxes in America, the federal government had never collected more that 21% of the Gross National Product (GNP) in revenue. This phenomenon is called Tax Capacity. At this very moment the federal government is spending 22.75% of GDP. We are spending more than it is possible to collect.

Are we Zimbabwe? No? But, we do have much farther to fall if we climb to where Zimbabwe was. Are there lessons to be learned? For sure. We need to spend much less and strengthen our currency rather than debauch it.

But, at the rate we are going, maybe what we are all about learn, is the name of the number that comes after trillion.

RSS Feed

RSS Feed